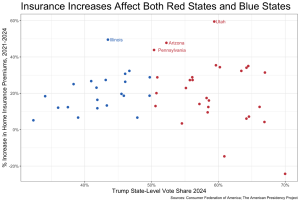

Rising home insurance costs have stretched the budgets of consumers across the country, with homeowners paying dramatically higher premiums, reducing coverage, or even foregoing insurance altogether. A recent CFA report found that the average premium for a typical homeowner increased by 24% (well above the rate of inflation) from 2021 to 2024. When we plot the percent increase (on the y-axis) against Trump’s vote share in 2024 (on the x-axis) for every state, no pattern emerges. This shows that consumers in “red states” were just as likely to experience premium increases as consumers in “blue states.” The insurance crisis is affecting all Americans and demands attention from policymakers in both parties.

In response to the insurance crisis, lawmakers and regulators in states as diverse as Idaho, Minnesota, Louisiana, Montana, and Colorado are working to gather more data, reduce risk, and lower insurance costs. But the Trump administration is adopting three policies that utterly ignore the crisis and will drive up insurance costs.

- Cutting Essential Disaster Relief

Earlier this year CFA’s Director of Housing Sharon Cornelissen wrote about how this block grant program provided over $300 million in disaster relief funding for eastern Kentucky, a low-income area with few internal resources to draw upon. She noted that “Federal HUD support has meant that thousands of Kentuckians have a home again. It is also helping to protect the future of the broader Eastern Kentucky community: the destruction of nine thousand homes has been an existential threat for the future of this entire region. Without rebuilding, rural communities such as those in Eastern Kentucky risk entering a downward spiral of no return, as too many families leave to sustain local economies and small businesses.”

If HUD’s disaster relief is gone, regions affected by natural disasters will experience a lot of pain. People and communities will lack the resources needed to recover from these catastrophes, and to rebuild homes and infrastructure in more resilient ways. Less disaster relief means more devastated communities without the ability to recover—and these communities will pay higher insurance premiums as a result.

- Dismantling the Building Resilient Infrastructure and Communities (BRICS) program

Ignoring both its popularity and efficacy, the administration is cancelling BRIC and announced that FEMA will not merely stop providing future grants, it will stop funding currently existing community projects that are not yet finished. That will result in a lot of wasted time, effort, and money—without the BRIC grants, many of these projects will languish unfinished, “crush[ing] projects that are underway,” according to one former FEMA official. Ending BRIC means terminating mitigation projects that would have saved lives, lowered the risk of property loss, and reduced homeowner, farm, and business property insurance premiums. Ending BRIC, in other words, means killing a key component of creating premium relief.

- Undermining the National Oceanic and Atmospheric Administration (NOAA)

NOAA’s data and tools are particularly relevant to the insurance industry, as well as to insurance policymaking. Its data and science are crucial guides for risk assessment and loss prediction. Yet the Trump administration is attempting to dismantle NOAA and its work. On May 8th, the administration announced that it will no longer update NOAA’s database of climate and weather disasters that cause at least $1 billion in damage. This free public resource has been immensely helpful for consumer advocates, emergency managers, and the insurance industry. A few weeks ago, hundreds of climate workers were fired from the agency, after having spent weeks in limbo while the courts determined whether the administration had the power to do this. The administration further plans to cut NOAA’s budget by 27%, taking us “back to the 1950s in terms of our scientific footing.”

Without the tools and data collected and freely provided by NOAA, it will be more difficult to assess risk and simulate major natural disasters and the losses that stem from them as catastrophe models often rely on NOAA data. We’ve argued that there needs to be more transparency when insurers rely on models to set rates and pricing but we never imagined that an administration would simply eliminate the data underlying the models.

Thankfully, these proposals to undermine NOAA are receiving a lot of pushback. The Reinsurance Association of America sent a letter praising NOAA and asking the Trump administration to preserve public access to a number of NOAA resources, including wind and hail climatology and data, research on billion dollar disasters, and efforts to track hurricanes. Eight members of the House of Representatives echoed these points in a separate letter. And the American Meteorological Society and the National Weather Association issued a statement criticizing these proposals, saying that “NOAA research costs every American citizen less than a cup of coffee per year, with large returns on this small investment.” A cup of coffee per year is a small and efficient price to pay for accurate information that helps predict risk and reduce insurance costs.

At a time when homeowners are struggling to afford home insurance premiums, the Trump administration is pursuing policies that will increase insurance costs for consumers. It’s not hard to model why that is a disaster.