Mitria Wilson Spotser Joins CFA as Director of Housing

Washington, D.C. — Consumer Federation of America is pleased to announce the appointment of Mitria Spotser as Director of Housing, effective July 27. Mitria succeeds Barry Zigas in this role, who has become a Senior Fellow at CFA.

“Mitria comes to CFA with extraordinary experience as an advocate for consumer-friendly housing finance and mortgage policies at National Community Reinvestment Coalition, Center for Responsible Lending, House Committee on Financial Services and most recently as Sr. Director of Advocacy and Counsel at Credit Union National Association (CUNA). She also has experience in the private practice of law, and as clerk to both a federal district judge and state supreme court justice,” said Jack Gillis, CFA’s Executive Director, in announcing her appointment. “Mitria will expand on CFA’s advocacy for fairness, access and transparency in the housing and mortgage marketplace,” said Gillis.

“In his role as Senior Fellow at CFA, Barry will continue to co-chair CFA’s Consumer Lender Roundtable, as well as support Mitria and the rest of the CFA team with his many years of experience in the housing finance arena,” added Gillis.

Contact: Jack Gillis, 202-939-1018

Our Subject Matter Experts

Sharon Cornelissen

Director of Housing

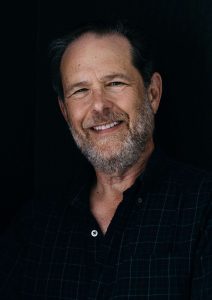

Barry Zigas

Senior Fellow

Press Releases

Trump’s CFPB Once Again Harms Servicemembers

Anti-Competitive State Laws Cost New Car Buyers More Than $20 Billion Per Year

Congressional Proposal Does Little to Protect Consumers from Unknowingly Purchasing Wrecked Cars